TOKYO (AFP) ― In highly-literate and

gadget-loving Japan, e-books are curiously rare ― but battle for the

largely-untapped and potentially hugely lucrative market is about to

commence.

When e-commerce giant Rakuten unleashes its Kobo e-reader onto Japan later this month, it will fire the opening shots in the scrap for literary territory, hoping for a slice of the $23.5 billion Japanese spend on books annually.

The Kobo is set to be joined later this year by a Japanese version of the Kindle, Amazon’s world-leading e-reader, pitting two of the planet’s biggest names in e-books against each other.

At around $100 for a device ― a price in line with Amazon’s offering in the U.S. ― both firms will be looking to lock customers in to their format with their eyes on the content prize, where the real money is to be made.

“I want to start the reading revolution in Japan and in the world with Kobo,” Rakuten chief executive Hiroshi Mikitani said Monday as he announced the July 19 launch.

“Kobo is a global device, a global platform, which allows anyone in the world to enjoy a variety of content.”

Material in Japanese will initially be limited to about 30,000 titles but Rakuten said it was aiming to grow that figure to about 1.5 million over the coming years.

Japan’s existing e-book market is largely a niche segment, mostly comprising comic books for mobile phone users.

Only a limited number of novels and non-fiction titles have been digitised in Japan, where the unique language protects publishers from foreign competition.

The situation has long frustrated IT-ready Japanese bookworms, some of whom have made their own ebooks by dissecting printed works and scanning the pages for their tablet computers.

But that is about to change.

Late last month Amazon broke years of strategic silence and said it would soon announce Kindle’s launch in Japan.

Sony is also trying to cultivate the market with a slick “Reader” device, supported by its own e-book store with nearly 60,000 Japanese language titles.

That is more than enough to cover best-sellers, but still woefully incapable of keeping up with the 80,000 new books published in Japan every year.

Publishers, already facing falling paper book sales, have so far been reluctant to digitise their books for fear that e-books could kill physical sales.

But with the coming of behemoths such as Amazon, they have been galvanised by fears that a market-rejuvenating platform might slip from their grasp, said Yashio Uemura, communications professor at Senshu University. “The industry is feeling a sense of crisis that, if they do nothing and stay passive... huge foreign IT firms could take the e-book market,” said Uemura.

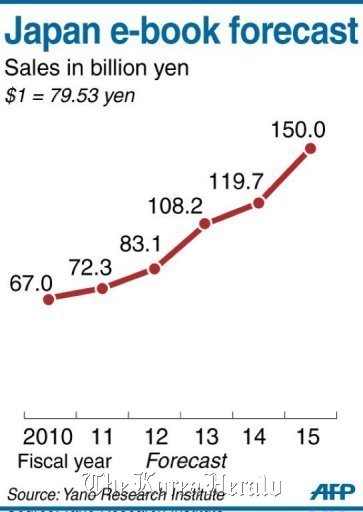

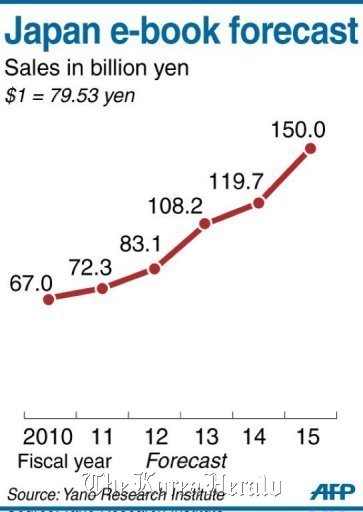

The sector should more than double to 150 billion yen ($1.9 billion) in 2015, from 67 billion yen in 2010, according to a study by Yano Research Institute, but will still be dwarfed by sales of physical books.

Other research firms have given more aggressive forecasts, amid high hopes for the Kindle.

The market for e-reader devices should soar to a whopping 70 billion yen in 2015 from a mere two billion yen in 2010, Yano Research said.

Amazon’s entry, it said, “could trigger a significant expansion of available digital book titles over the next two to three years”.

Kindle, launched in 2007 in the United States, has enjoyed phenomenal success among English-language readers.

In the U.S., adult e-book sales surpassed those of hardback books for the first time in the first quarter of 2012, according to the Association of American Publishers, jumping 28 percent year-on-year to $282.3 million, compared to $229.6 million for hardbacks, up 2.7 percent.

Uemura is a key member of a new firm, created in April by a group of top publishers and a government-backed investment body, tasked with helping Japanese publishing houses digitise one million book titles in five years.

That means making e-versions of all books that can be purchased in Japan, plus a selection of out-of-print titles.

“In this country, where people love new gadgets, it’s inconceivable that digital content won’t enjoy strong sales,” he said.

When e-commerce giant Rakuten unleashes its Kobo e-reader onto Japan later this month, it will fire the opening shots in the scrap for literary territory, hoping for a slice of the $23.5 billion Japanese spend on books annually.

The Kobo is set to be joined later this year by a Japanese version of the Kindle, Amazon’s world-leading e-reader, pitting two of the planet’s biggest names in e-books against each other.

At around $100 for a device ― a price in line with Amazon’s offering in the U.S. ― both firms will be looking to lock customers in to their format with their eyes on the content prize, where the real money is to be made.

“I want to start the reading revolution in Japan and in the world with Kobo,” Rakuten chief executive Hiroshi Mikitani said Monday as he announced the July 19 launch.

|

| The Kobo Touch e-reader (Bloomberg) |

“Kobo is a global device, a global platform, which allows anyone in the world to enjoy a variety of content.”

Material in Japanese will initially be limited to about 30,000 titles but Rakuten said it was aiming to grow that figure to about 1.5 million over the coming years.

Japan’s existing e-book market is largely a niche segment, mostly comprising comic books for mobile phone users.

Only a limited number of novels and non-fiction titles have been digitised in Japan, where the unique language protects publishers from foreign competition.

The situation has long frustrated IT-ready Japanese bookworms, some of whom have made their own ebooks by dissecting printed works and scanning the pages for their tablet computers.

But that is about to change.

Late last month Amazon broke years of strategic silence and said it would soon announce Kindle’s launch in Japan.

Sony is also trying to cultivate the market with a slick “Reader” device, supported by its own e-book store with nearly 60,000 Japanese language titles.

That is more than enough to cover best-sellers, but still woefully incapable of keeping up with the 80,000 new books published in Japan every year.

Publishers, already facing falling paper book sales, have so far been reluctant to digitise their books for fear that e-books could kill physical sales.

But with the coming of behemoths such as Amazon, they have been galvanised by fears that a market-rejuvenating platform might slip from their grasp, said Yashio Uemura, communications professor at Senshu University. “The industry is feeling a sense of crisis that, if they do nothing and stay passive... huge foreign IT firms could take the e-book market,” said Uemura.

The sector should more than double to 150 billion yen ($1.9 billion) in 2015, from 67 billion yen in 2010, according to a study by Yano Research Institute, but will still be dwarfed by sales of physical books.

Other research firms have given more aggressive forecasts, amid high hopes for the Kindle.

The market for e-reader devices should soar to a whopping 70 billion yen in 2015 from a mere two billion yen in 2010, Yano Research said.

Amazon’s entry, it said, “could trigger a significant expansion of available digital book titles over the next two to three years”.

Kindle, launched in 2007 in the United States, has enjoyed phenomenal success among English-language readers.

In the U.S., adult e-book sales surpassed those of hardback books for the first time in the first quarter of 2012, according to the Association of American Publishers, jumping 28 percent year-on-year to $282.3 million, compared to $229.6 million for hardbacks, up 2.7 percent.

Uemura is a key member of a new firm, created in April by a group of top publishers and a government-backed investment body, tasked with helping Japanese publishing houses digitise one million book titles in five years.

That means making e-versions of all books that can be purchased in Japan, plus a selection of out-of-print titles.

“In this country, where people love new gadgets, it’s inconceivable that digital content won’t enjoy strong sales,” he said.

No comments:

Post a Comment