|

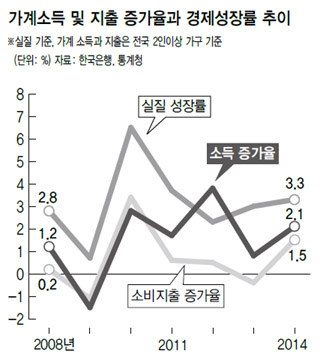

Data from Statistics Korea and the Bank of Korea showing increases in household income (the dark gray line), real economic growth (medium gray line) and real consumer spending growth (light gray line) in 2008, 2011 and 2014. The graph shows how income growth consistently lags behind real economic growth, as does real consumer spending growth.

|

The economy is growing, but growth in wages aren’t keeping up, leading to uneven distribution of wealth

2014 witnessed the continuation of “undistributed low growth,” in which the real rate of increase in household income fell short of the economic growth rate. With households cutting their spending as income growth slows to a crawl, the consumption tendency (the ratio of consumer spending to disposable income) fell to its lowest level ever.

In order to keep this economic pattern from taking hold, the South Korean government needs to craft policies that can activate the virtuous cycle of economic growth, growth in household income, increased spending, and economic growth, experts say.

According to the results of a study by Statistics Korea on household trends, published on Feb. 13, the average monthly income in 2014 for households of two or more people was 4.3 million won (US$3,917), a 3.4% increase year on year. In terms of real income, which takes into account the inflation rate, this represents a 2.1% increase.

Compared to 2013, when the rate of increase of real income hovered around 0%, the household income situation has improved, but it is still much lower than the economic growth rate. The estimated real economic growth rate for 2014 was 3.3%, more than 1 percentage point higher than the household income growth rate.

What this means is that the household income is not increasing fast enough to keep up with economic growth, a phenomenon that became noticeable in the previous decade.

Last year, Park Jong-gyu, a senior analyst for the Korea Institute of Finance (KIF), argued that the slow growth of household income is linked to the fact that wages are not keeping up with improving productivity, coming up with the concept of “wage-free growth.”

The consumer spending growth rate was much lower than the income growth rate. Average monthly consumer spending per household last year was 2.55 million won (US$2,323), just a 2.8% increase from the previous year. The real consumer spending growth rate was 1.5%.

With household consumption increasing more slowly than household income, the average monthly household surplus amount and surplus rate were 946,800 won (US$862) and 27.1%, the highest levels since the government started tracking these figures in 2003. This reflects the extent to which households are tightening their belts.

As a result, the average consumption tendency set a new low, dropping 0.4 percentage points from the previous year to 72.9%.

The statistics show a modest decrease in income equality. For the first quintile - the lowest 20% of wage earners - income went up by 5.6%, higher than the average (3.4%), as well as all other quintiles. As a result, the income of the fifth quintile, or the top 20%, surpassed the income of the bottom 20% by a factor of 4.45 in 2014, the lowest level since 2004.

One major factor appears to have been the basic pension system, which took effect in July of last year. The system, which disburses up to 200,000 won (US$182) a month to elderly people (65 years and older) in the lowest 70% income bracket, was expected to help increase the average income for low wage earners. South Korea is characterized by a high rate of poverty among the elderly.

“We need to reinforce the virtuous cycle in which growth in household income leads to more spending. More specifically, we are planning to develop productivity indices for each industry to strengthen the connection between wages and productivity. We will also keep encouraging companies in the private sector to voluntarily raise wages by incrementally raising the minimum wage,” said Ju Hwan-uk, chief of strategic planning for the Ministry of Strategy and Finance.

By Kim Kyung-rok, staff reporter

Please direct questions or comments to [english@hani.co.kr]

No comments:

Post a Comment